My package was stopped by customs and never arrived….

I was looking forward to my shipment from Japan.

If customs duties are taken or the product does not arrive for a long period of time due to customs procedures.

It’s a very low tension….

But.

In what cases are tariffs charged and how much?”

If you know in advance the rule that

“I’ve been hit with tariffs!” You can greatly reduce the number of tragedies such as

Hi, I’m Harie, an expat wife in Germany!

I’ve received packages from Japan many times while I’ve been here.

I have yet to be charged customs duty!

As a matter of fact, customs rules can be checked in advance at the customs offices or embassies of each country.

In this article.

Here is a summary of the customs rules in Germany, where I live.

This will give you an idea of the precautions you need to take when having your package sent from Japan!

Although some tax rates are different.

Other EU countries should have almost the same rules, so please refer to them.

この記事は2021年3月時点の情報です。ここ最近制度が大きく変化し、私もついに関税を取られてしまいました・・でも半分は取り返しました!近日中(2023年2月中)に記事を大幅アップデート予定ですので少々お待ちください。

You might be also interested in these articles

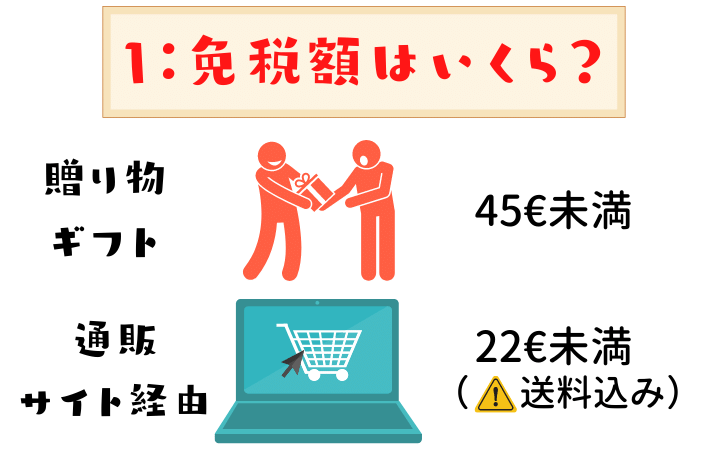

Japan to Germany luggage: Customs rules can be divided into two patterns

According to the German Customs website, shipments from Japan can be divided into the following two cases

- ギフト(贈り物)

- オンラインショッピングの荷物

(1) is for gifts from family and friends living in Japan.

In this case, the

Tax free if less than 45 euros and certain conditions are met

The first two are the following.

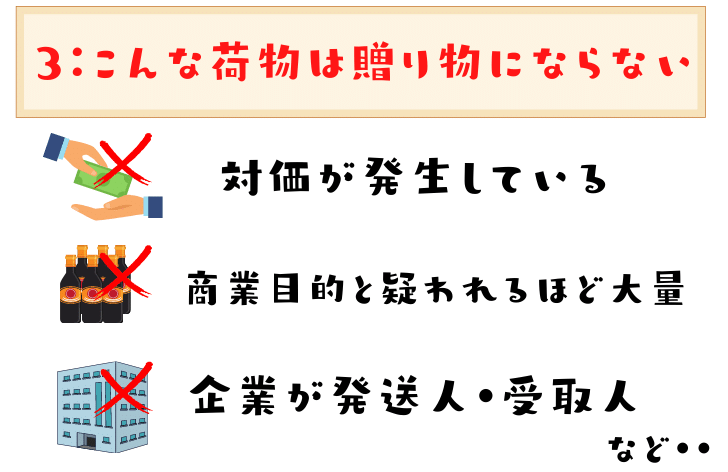

The key to whether or not it’s a gift is that it’s

It must be “person-to-person.”

The “thing sent without consideration = no money exchanged.”

贈物は個人から個人宛に、対価を得ることなく送られた物でなければなりません。企業が発送人・受取人となっている物は贈物に該当せず、関税・税金が発生します。

Mail to Germany – Embassy Consulate-General of the Federal Republic of Germany

(2) is a package from a mail order site, etc.

This is taxable unless it is a small amount.

Let’s take a closer look at each case.

There are different rules for baggage for commercial purposes. Please check the German Customs website for details.

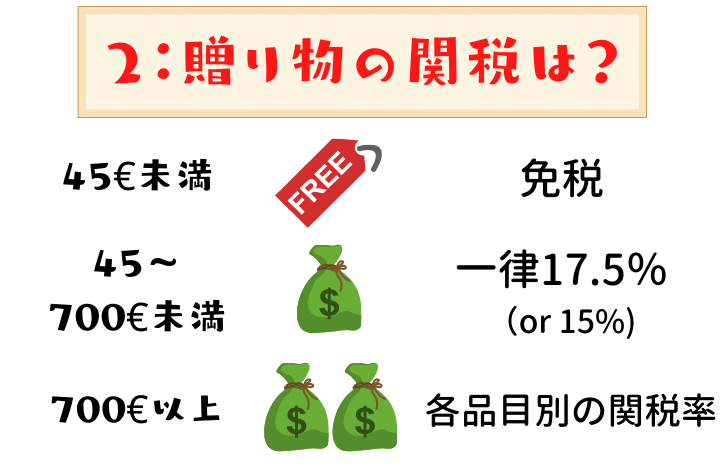

Packages from Japan to Germany: How much is the customs duty on gifts (gifts)?

For gifts

The following customs duties apply to shipments from Japan.

| total amount | tariff rate |

|---|---|

| Less than 45 euros | tax exemption |

| 45 to less than 700 euros | Flat rate of 17.5% (or 15%) |

| More than 700 euros | Tariff rates for each item |

Gifts under 45 euros

Certain conditions are met No customs duty is charged on gifts under 45 euros.

Customs formalities are also no longer required.

The Japanese Embassy and the German Customs website also have

If certain conditions are met.

It is firmly stated that anything less than 45 euros is tax free.

個人が送る小型荷物の大半は贈物として扱われます。次の条件を満たす物は免税令(第25条~第27条)の定めにより関税が免除され、税関手続も不要です。

Mail to Germany – Embassy Consulate-General of the Federal Republic of Germany

In most cases, private small items are gift items. These shipments are duty-free and are not subject to any customs formalities if the following conditions are met (Art. 25 to 27 Customs Exemption Ordinance):

Gift shipments – Zoll

So if it’s less than 45 euros it’s tax free!

At least it’s a relief!

Certain conditions for tax exemption will be discussed later.

Gifts from 45 to less than 700 euros

For gifts over 45 euros that meet certain conditions

A flat 17.5% or 15.0% tariff is applied.

The tariff rate for each item above 700 euros will be charged.

For more details, please refer to the chapter “Online Shopping Tariffs”.

What are certain conditions for the gift tariff rules to apply?

So far, gifts have been

Tax free if less than 45 euros

A flat 17.5% or 15.0% tariff if less than €45-700

I explained.

But for this rule to apply

The following conditions must be met

- 特定の品目については、定められた範囲を超えないこと

- 個人から個人に宛てた不定期の荷物であること

- 無償の荷物であること(受取人は一切の支払、反対給付その他の給付を行わないことが免税条件であるため、物々交換等は課税対象となります)

- EUの関税領域およびヘルゴランド島以外から発送されたものであること

- 個人使用または受取人宅での消費のみを目的とし、かつ商業目的との疑いを生じさせない程度の形態と量であること

(Citation: Mail to Germany – Consulate-General of the Federal Republic of Germany)

*2) Specific items are coffee, cigarettes, alcohol, perfumes, etc.

When your package is stopped by customs or you get charged customs duty even though it’s less than 45 euros.

It is possible that one of these conditions is not met (or suspected to be met).

Indeed, when I think back on all the packages I’ve had stopped by customs.

I might have been stuck on one of these.

For example…

Here are the contents of the baggage stopped by customs.

- しょうゆ1ℓ 3本

- みりん風調味料1ℓ 3本

- 豆板醤 5瓶

The large quantity of the same type of product was suspected to be for commercial purposes.

You had doubts about the tax exemption condition (5) mentioned earlier.

I was living in Poland at the time.

Polish customs was rather appropriate because

I went to customs and told them that it was for personal use and was easily granted tax exemption.

I am not sure if it would be so readily OK in Germany….

Packages from Japan to Germany: What I do to avoid being stopped by customs

To avoid unnecessary suspicion from customs, you should

When you get money sent to Germany from your family in Japan

We have asked them to devise the following

- 総額45ユーロ未満にする

- 同じ種類のものを大量に入れない

- 値札や包装、外箱はすべて取る(商業(転売)目的だと疑われないように)

- 納品書や請求書と間違われるような書類は入れない(有償の荷物だと疑われないよう)

- 宛名・送り名は個人名で(実家から私宛の荷物なので会社名になることはないですが、一応。。)

Other than that, I’d like to make sure you don’t suspect it’s a package from an online shopping spree.

Boxes with the logos of Amazon, Rakuten, and other online shopping sites.

Some people try not to use them for packing.

I have trouble telling my friends about these detailed mileage rules.

Don’t send me packages!” (laughs).

Multiple packages, watch your shipping dates!

The total value of a package is the sum of packages “shipped on the same day”, not per box.

「荷物」は個人が個人に宛てて同じ日に発送し、一つの税関で手続を受ける物品の単位で、箱の個数は不問です。

Mail to Germany – Embassy Consulate-General of the Federal Republic of Germany

If you are having multiple packages sent from Japan

It would be safer to have them do one box a day.

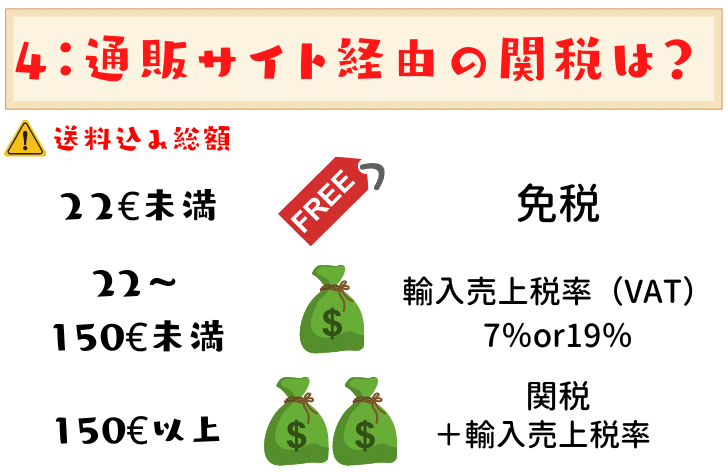

Packages from Japan to Germany: How much is the customs duty for online shopping?

When sending packages purchased from Japanese online shopping sites to Germany

The following customs duties and import sales taxes will be paid

| Total amount (including shipping ) | tariff (import tax) | Import Sales Tax (VAT) |

|---|---|---|

| Less than 22 euros | tax exemption | tax exemption |

| Less than 22 to 150 euros | tax exemption | 7% or 19 |

| 150 EUR or more | Tariff rates for each item | 7% or 19 |

Noteworthy.

That the total price will “include shipping!”

The value of the consignment is decisive for calculating the import duties. What matters is what amount was actually paid to receive the goods. If the final invoice amount includes postage costs, these will not be deducted.

Internet orders – Zoll

The German Customs website also states that shipping costs are included in the total amount.

Even though shipping from Japan to Germany is expensive…. This hurts!

In addition, online shopping packages mainly include

- 関税

- 輸入売上税(=VAT)

or both.

one word “tariff” means customs duties

There are several types of them!

Cigarettes, alcohol, coffee, etc. are subject to a separate consumption tax in addition to customs duties and import sales tax.

possibly consumption taxes , including energy tax, tobacco tax, alcohol tax, alcohol tax, beer tax, sparkling wine and intermediate product tax and coffee tax, for all goods subject to excise duty

Internet orders – Zoll

Luggage less than 22 euros

Online shopping baggage under 22 euros is duty free.(excluding cigarettes, alcohol, coffee, etc.)

Shipments of goods with a total value of no more than 22 euros can be imported without the collection of import duties.

Internet orders – Zoll

However, since it’s less than 22 euros ‘including shipping’.

Realistically, there may not be many cases where this applies.

Luggage less than 22-150 EUR

Online shopping packages over 22 euros are subject to an “Import Sales Tax”.

Import sales tax is a tax on

VAT (value-added tax), the Japanese equivalent of consumption tax.

Even within the EU, tax rates vary from country to country.

付加価値税は、輸入品に対しては輸入売上税(Einfuhrumsatzsteuer)として課せられる。

German Customs System – JETRO

In Germany.

Daily necessities such as groceries and books account for 7%, and the rest 19%.

In addition, there is an additional customs fee of 6 euros to be paid to the carrier.

2018年3月からはドイツポストとDHLは22ユーロより高い商品では税関手数料6ユーロを徴収し、通関手続きをして直接家まで届けてくれるようになりました。

About Customs (International Mail and Online Shopping) – Germany News Digest

Luggage over 150 euros

For online shopping parcels over 150 euros, you can

Both “customs duty” and “import sales tax” will be paid.

Customs duty rates vary depending on the product.

(For more information, please refer to the German Customs website.)

It was on the German Customs website.

I found the “Example of tariff calculation for a blouse bought from Japan” easy to understand.

Here’s a translation for you!

- ブラウス:200ユーロ

- 送料:35ユーロ

- ブラウスの関税率:12%

- ブラウスの輸入売上税率(ドイツ):19%

Tariffs

(blouse cost 200€ + shipping cost 35€) x tariff rate 12% = 28.2€.

Import Sales Tax

(cost of blouse and shipping 235€ + customs duty 28.2€) x import sales tax rate 19% = 50.01€.

[Total = amount paid to customs

28.2€ + 50.01€ = 1 78.21€ + 50.01€ = 28.2€ + 50.01€ = 50.01€

Oh my god, if you buy a 200 euro blouse online in Japan…

78 euros in taxes will be taken…!

Too expensive…! Fearful…

AmazonGlobal’s international shipping includes customs duty.

The tariff rules are too complicated…

I was afraid of unexpected tariffs.

I can’t order from Japanese online shopping…

If you are worried about customs duties, we recommend using AmazonGlobal’s international shipping.

They will calculate in advance the estimated amount of import taxes, duties, and other fees that will be charged at customs clearance.

You can then pay that estimated tariff together when you buy the goods.

(Eligible countries only. Click here for eligible countries )

If actual import duties are lower than estimated, the difference will be refunded and

If actual import duties are higher than estimated

They will not charge you anything new!

Amazon is so generous…!

There are no unexpected tariffs to pay.

If you are worried about customs duty, I think it is easiest and safest to buy Japanese goods from AmazonGlobal.

For more information, please refer to the Advance Payment of Import Taxes and Other Tax es within Amazon.

It’s also important that you don’t pack anything in your luggage that’s not allowed to be sent overseas!

If you know the above tariff rules in advance, you can

They could be hit with unexpected tariffs or

This can greatly reduce the possibility of being stopped by customs for an extended period of time.

Besides the tariff rules, there’s one more thing to watch out for!

It is.

Don’t carelessly include in your luggage items that are forbidden to be sent overseas or prohibited to be imported!

Prohibited items are listed on the websites of embassies, customs offices, and shipping companies in each country.

Check once before sending your package.

I often check the Japan Post website.

Easy to see and convenient♪

Know the rules of customs and send your goods wisely from Japan.

Long story short, that’s all the tariff rules I could find out!

If your luggage gets stopped at customs.

It can take more than twice as long as usual for a package to arrive…

I had to go all the way to customs to pick it up…

They charge customs duty and…

If you don’t pick it up by the deadline, it will be sent back to Japan…

And there is not one good thing (laughs).

Therefore.

If it’s a gift, keep it under 45 euros.

If you’re shopping online, you can use AmazonGlobal to pre-pay your customs duties, for example.

We recommend that you take steps in advance to ensure that you are less likely to be stopped by customs!

Also, if the gift is a

Ask a family member to save the price tag and packaging.

Such as not sending the same thing in large quantities.

Better yet, make sure customs doesn’t suspect you!

If you are still unlucky enough to be stopped by customs, you are already lucky (laughs).

Responses vary considerably depending on the staff member in charge.

Some people are amazingly Texan, some are pretty strict, and some are just…

This is really just luck.

Let’s do everything we can to make sure it gets there, and then pray it gets there safe and sound!

My package from Japan got tariffed!